Investment Options

Maximize Your Savings with Fort Billings

At Fort Billings FCU, we offer a range of investment options tailored to meet your financial needs at every stage of life, providing peace of mind and steady growth. Explore our distinct savings solutions and find the perfect fit for your financial goals:

Share Certificates (CD)

Securely boost your savings with our Share Certificates. Ideal for diversifying your portfolio or saving for specific goals like your child’s education, these risk-free investments offer competitive returns:

- Minimum Investment: $500

- Flexible Terms: Choose from 6 to 60 months

- Federally Insured: Invest with confidence, knowing your funds are safe.

Access our Savings Calculator to see how your investment can grow.

Money Market Accounts

Enjoy higher yields without the constraints of long-term commitments. Our Money Market Accounts combine the benefits of both high earnings and cash access, allowing for flexibility along with growth:

- Minimum Balance: $2,000

- Transaction Limits: Up to six (6) transactions per month, including transfers, checks, or withdrawals

- Compounded Monthly Dividends: Accelerate your savings with dividends that grow monthly.

Individual Retirement Accounts (IRAs)

Plan a financially secure retirement free from stock market volatility. Start or transfer your IRA to Fort Billings FCU and enhance your financial security:

- Annual Contribution Limits: Up to $7,000, or $8,000 if you’re over 50, in line with IRS guidelines (subject to change).

- Range of Options: Select from various certificate options to customize your retirement savings.

- Market Protection: Your retirement funds are shielded from market fluctuations, ensuring steady growth.

- Range of Options: Choose from a range of certificate options for your IRA.

Our IRAs are tailored to meet your financial needs and goals at every life stage, providing peace of mind and consistent growth. Secure your retirement with confidence and stability at Fort Billings FCU!

Count on Higher Earnings

Each of our savings options is designed to offer security and competitive advantages, making it easier for you to manage and grow your wealth.

Safeguard your future with confidence and stability today.

Your Savings are Secure with Us

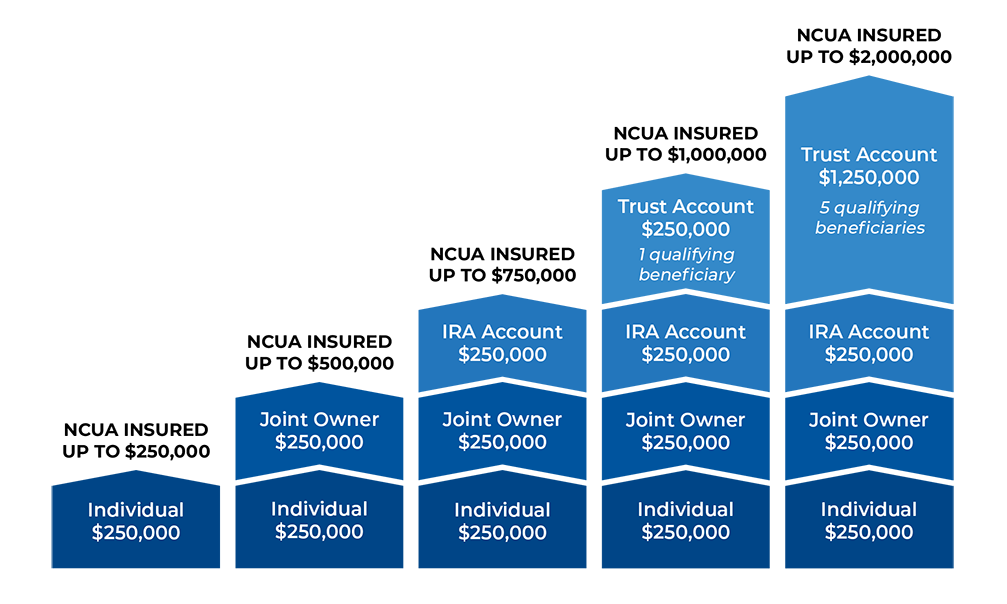

Rest easy knowing your deposits are safeguarded by the National Credit Union Administration (NCUA), a U.S. government agency. With the National Credit Union Share Insurance Fund (NCUSIF), your savings are insured up to $250,000 per share owner, per insured credit union, for each account category.

Your financial security is our top priority.

LPL Financial

Your Unique Investment Plan

At Fort Billings Federal Credit Union, our goal is to make a difference – for you, your family, and your future. Whether saving for college, working toward retirement, or building a legacy for you and your family, our LPL Financial Consultant, Albert Danish, can work with you to develop an investment plan aligned with your needs and goals.

Specializing in sound Retirement Strategies, Education, and Financial Concepts:

Investments:

Bonds

Common Stock

Educational IRA

Traditional IRA

Roth IRA

SEP IRA

Simple IRA

Brokerage Accounts

Treasury Bills & Notes

Government Securities

Variable & Fixed Annuities

Mutual Funds

Financial Planning:

Retirement Planning

Estate Planning

Education Planning

Family Financial Planning

Tax Plans

401(k) Planning

403(b) Planning

Money Purchasing Plans

Profit Sharing Plans

Business Planning

Asset Allocation

Insurance:

Disability Income Insurance

Life Insurance

Long-Term Care Insurance

Group Benefits

Call or email Albert today to set up your Free Financial Review

Albert Danish

Financial Representative

780 Parkway Blvd

Broomall, PA 19008

Office: 484-472-7704

Cell: 610-608-0574

albert.danish@lpl.com

www.yourlocaladvisors.com

No strategy assures success or protects against loss. There is no guarantee that a diversified portfolio will enhance overall returns or outperform a non-diversified portfolio. Diversification does not protect against market risk. Securities are offered through LPL Financial, Member FINRA/SPIC. Insurance products are offered through LPL Financial or its licensed affiliates. Fort Billings FCU and LPL Financial are not registered brokers/dealers nor affiliates of LPL Financial. Not NCUA Insured, Not Credit Union Guaranteed, May Lose Value.

Join Us Online in Minutes!

Opening an account online is quick and easy. You’ll need to start with a primary savings account, which requires a minimum deposit of just $5.00. This initial deposit represents your “share” in the ownership of the credit union, which is why your savings are referred to as “shares”.